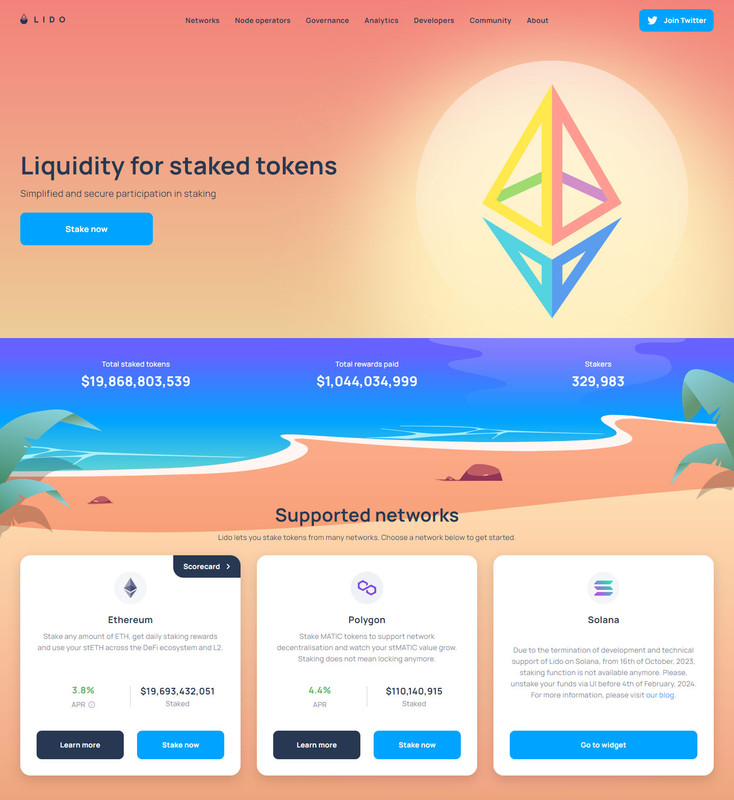

Introduced in 2020, Lido Finance is a popular liquid stacking solution in the DeFi (decentralized finance) sector. It provides a transparent, secure and reliable platform for staking digital tokens from several networks like Polygon, Ethereum, and Solana. Presently handling over $14 billion in staked virtual assets and serving around 300,000 stakers. Lido allows users to get daily perks and use their stTokens in the bigger DeFi ecosystem.

DAO (Decentralized Autonomous Organization) oversees the governance of Lido Staking, fostering active community engagement and making decisions. Lido Finance has undergone various stringent audits, ensuring its commitment to safety and reliability in the rapidly growing cryptocurrency market.

Liquid staking services such as Lido allow new customers to participate in protecting PoS networks like theirs by permitting them to stake PoS assets in exchange for block rewards. Lido offers an innovative solution to the obstacles presented by traditional proof-of-staking by successfully lowering hurdles to entry and the costs related to locking up users’ assets in a single protocol.

When users deposit assets to Lido Staking, the tokens get stacked on the Lido blockchain through the protocol. Hence, Lido is constructively a staking pool smart contract with the following features:

Since the transition of ETH to PoS, users who want to become staking validators can deposit at least 32 ETH, a steep lowest requirement to stake on the network. Solutions like Lido Finance make staking on ETH accessible by letting users stake fractions of Ether to receive block rewards. Ethereum staked on the protocol, then distributed to the validators and deposited to ETH’s mainnet, the Ethereum Beacon Chain, for authentication. Lido Staking locks up and secures the assets in a smart contract where no one can access them.

Let’s check out some significant services offered by Lido Finance:

Here are the instructions to connect and use Lido:

Step 1: Head to the official Lido Finance website using any preferred browser.

Step 2: Connect your desired crypto wallet. Lido operates blockchain networks, mainly Ethereum. You will require a compatible digital currency wallet such as Coinbase, MetaMask, or Trust Wallet.

Step 3: Access the staking platform. Once you connect your wallet, move to the deposit or staking section.

Step 4: Confirm and allow the essential transactions via the crypto wallet. This might involve allowing the staking transaction and paying the associated charges on the ETH network.

Step 5: After confirming the staking transaction, you will obtain stETH in the wallet. This shows the staked ETH on Lido.

Step 6: Users can generally track the performance of their staked Ethereum and handle their stake via the Lido Staking platform or their connected wallet.

Step 7: Once you decide to take out the staked Ethereum, follow the steps of the platform to complete the withdrawal procedure. This might involve allowing the withdrawal and paying the related fees.

Lido Finance is a secure liquid staking derivative platform popular for its persistent code reviews to maintain a reliable and safe framework. This ensures transparency and allows a proactive approach to find out and mitigate possible vulnerabilities. Using a DAO (decentralized autonomous organization) to take care of others accentuates its commitment to protecting users’ interests, permitting transparent and collective decision-making procedures that adeptly handle risk factors.

Furthermore, the platform leverages a committee of best-in-class, elected validators to lower staking risks, offering an extra layer of safety. This structure separates from the regular practice where users stake the assets with a single validator, thus centralizing risk. It is important to note that reputed firms like Quantstamp, MixBytes, and Sigma Prime audits Lido Staking, which provides a credible testament to its security protocols.

Lido Finance is known for its security and reliability in the evolving landscape of DeFi (decentralized finance). Its dedication to protecting users’ investments can be seen in its decentralized governance structure and continuous code reviews, fostering a collaborative and transparent environment. Also, its adherence to top-notch safety protocols vetted via vigorous audits by popular firms clearly shows its commitment to securing users’ assets.